3X ETF Morning Report 2/29/24

Website Tips: Your account link is listed below to manage your account

Account Link: [hidden link]

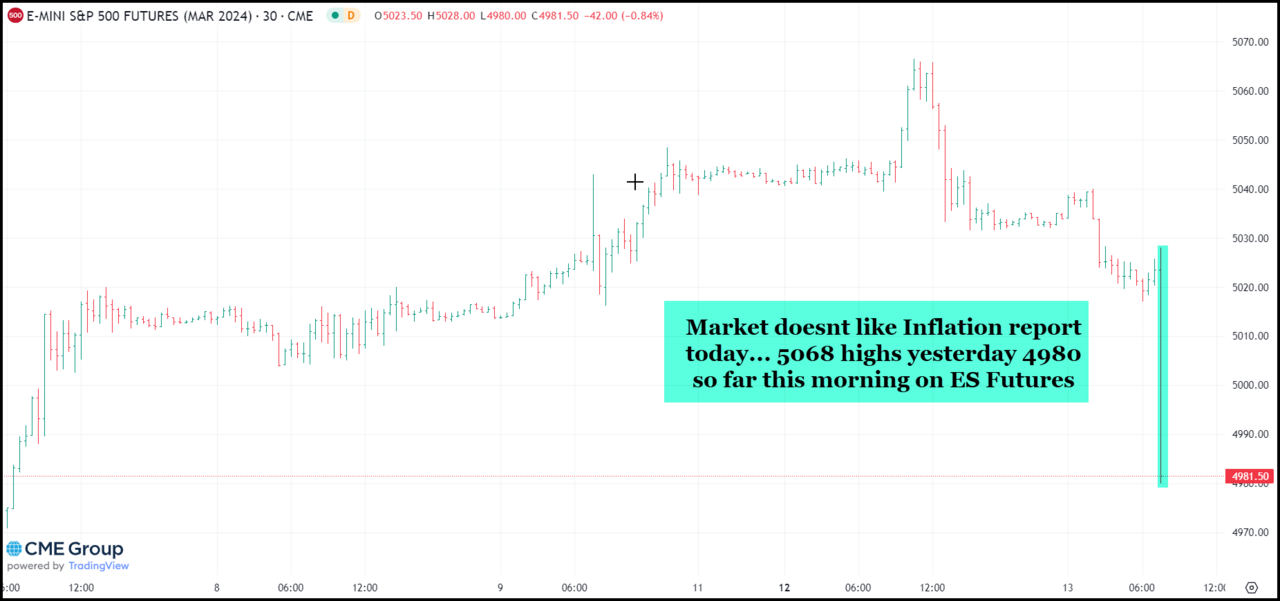

Markets: Futures up on benign PCE Inflation Report

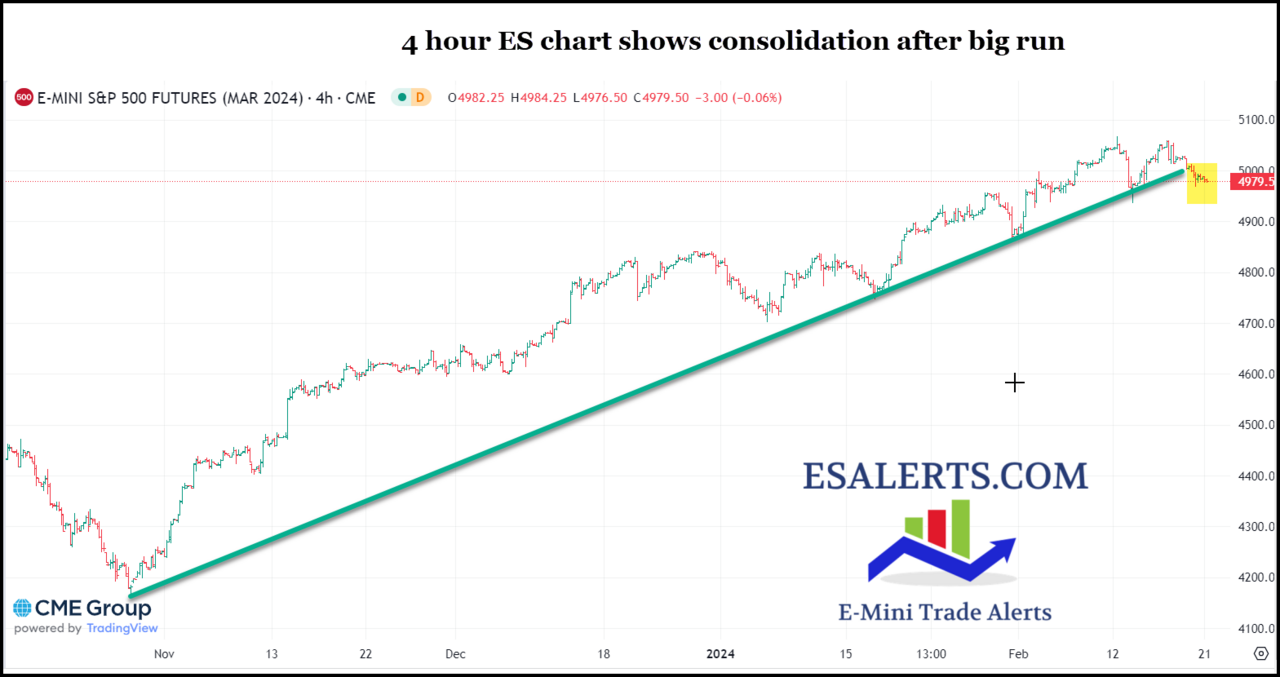

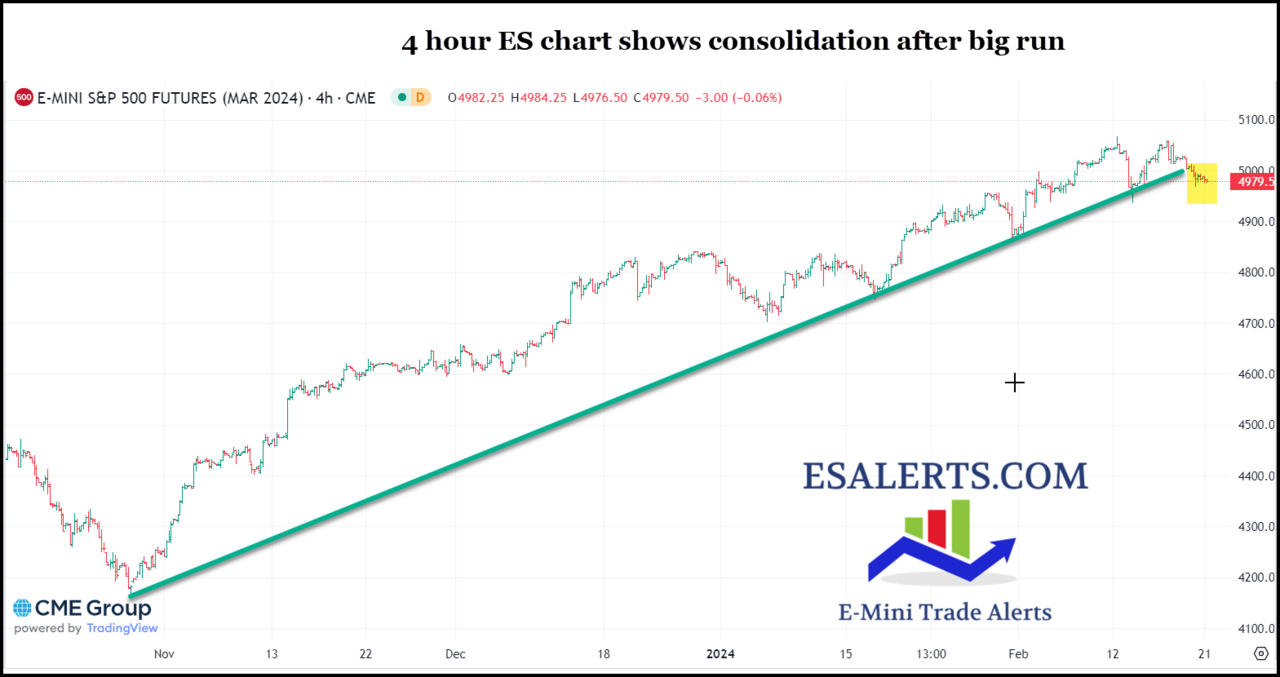

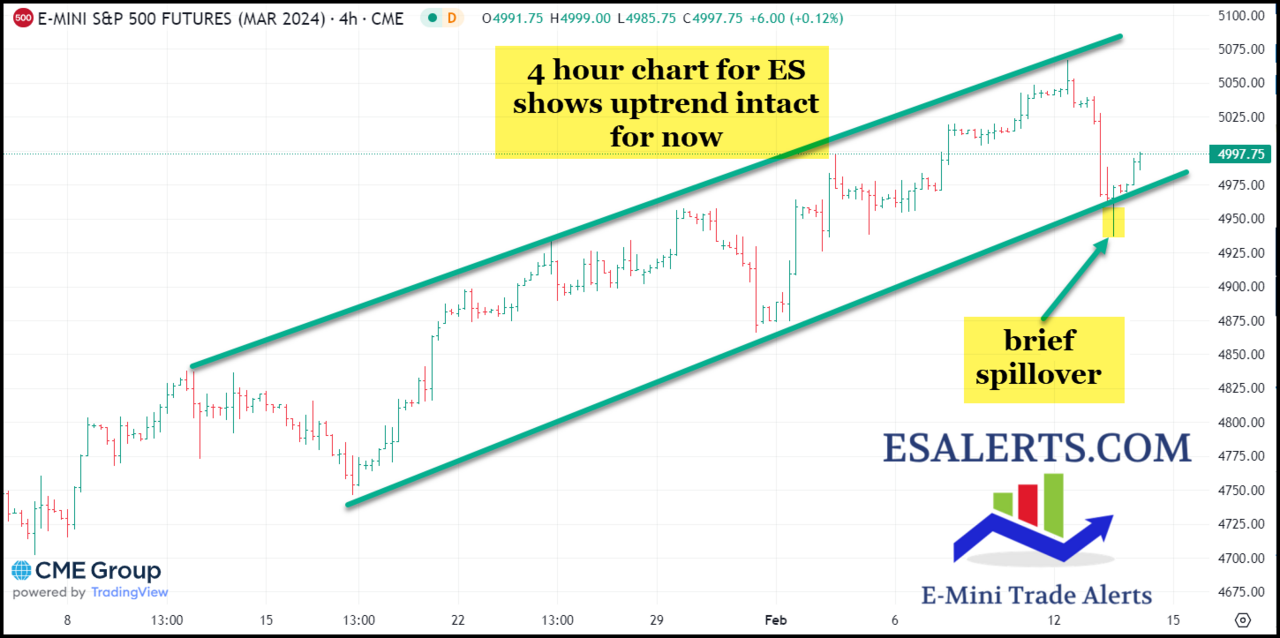

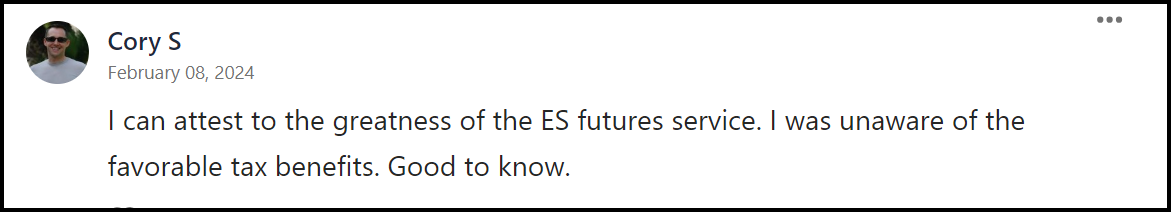

ES Alerts members are long the SP 500 via buying 5090 and 5065 dips this week, currently 5098. Markets could still push higher yet. Last week I had an ES (SP 500) chart showing 5110 area as likely resistance on the futures, that has held true so far. If…

Account Link: [hidden link]

Markets: Futures up on benign PCE Inflation Report

ES Alerts members are long the SP 500 via buying 5090 and 5065 dips this week, currently 5098. Markets could still push higher yet. Last week I had an ES (SP 500) chart showing 5110 area as likely resistance on the futures, that has held true so far. If…