ES Morning Update 4/8/24

Website Tips: Your account link is listed below to manage your account

Account Link: [hidden link]

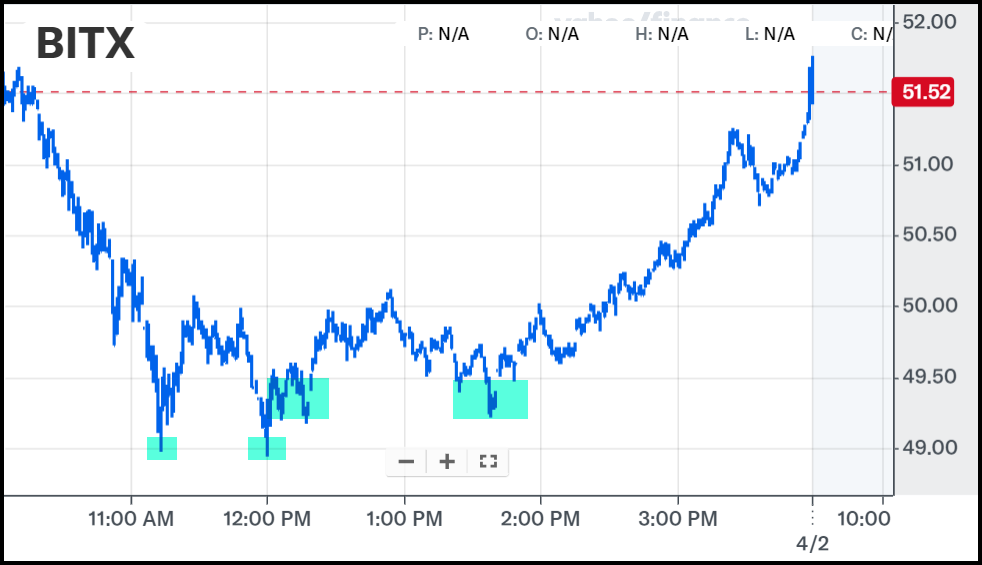

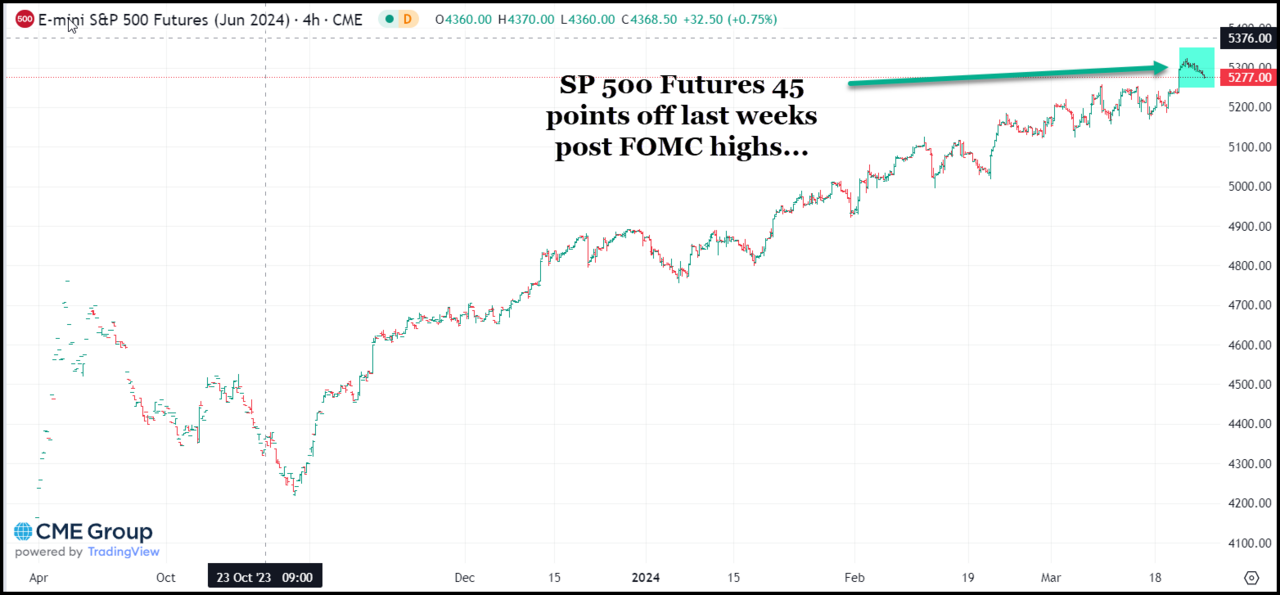

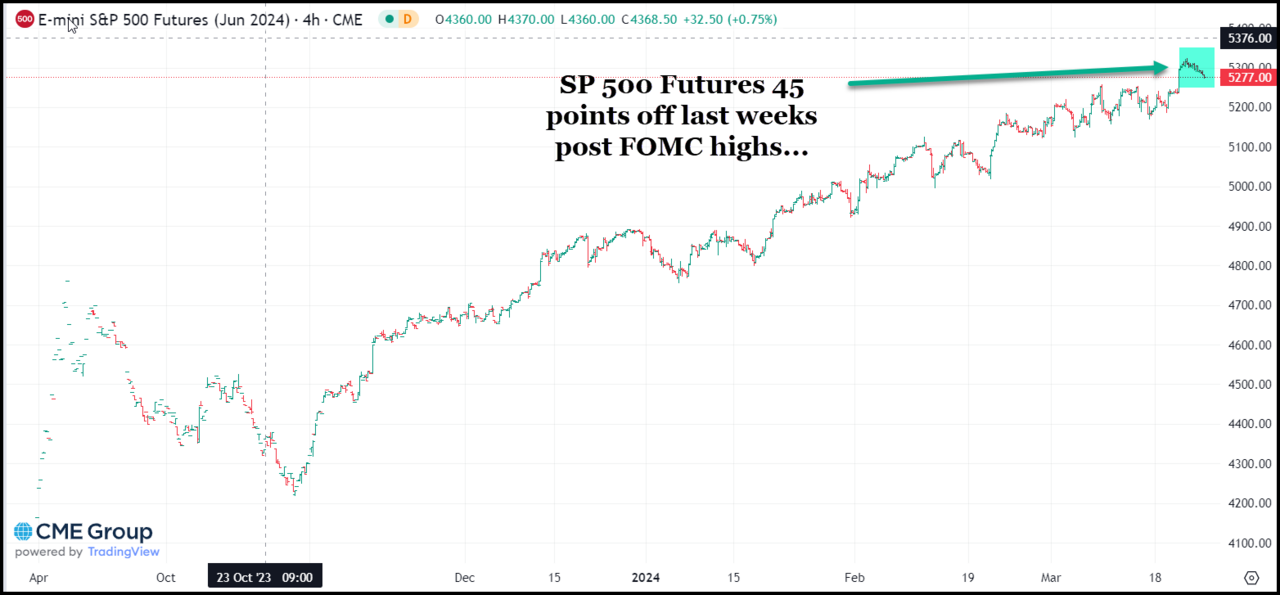

ES 5251

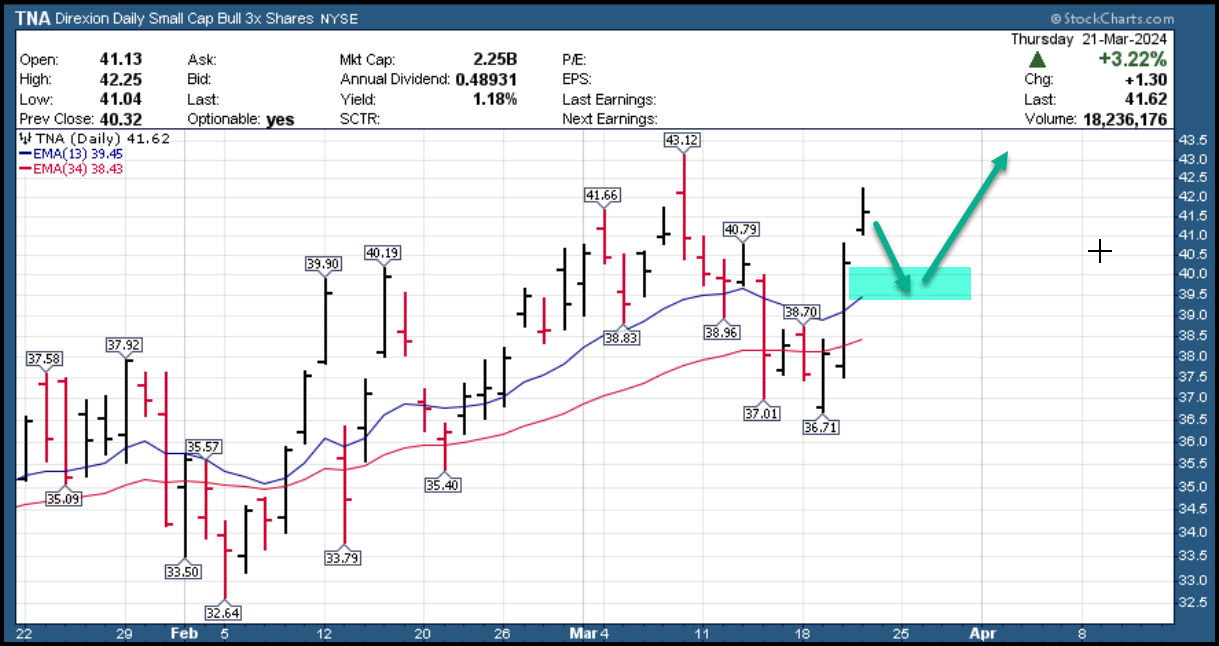

Key support at 5200 ends up holding for now last week after some volatile trade

5251 is below my prior 5260 stop point last week, so running up on some resistance here.

I still do not have a clear trade I'm comfortable with but stay alert if I send one out...likely a buy the…

Account Link: [hidden link]

ES 5251

Key support at 5200 ends up holding for now last week after some volatile trade

5251 is below my prior 5260 stop point last week, so running up on some resistance here.

I still do not have a clear trade I'm comfortable with but stay alert if I send one out...likely a buy the…