3x ETF A.M. Report Jan 21st

Web Version click link below :

MORNING REPORT LINK (Click to go straight to formatted web version)

📈 MARKET NOTES 1/21/26

MORNING REPORT LINK (Click to go straight to formatted web version)

📈 MARKET NOTES 1/21/26

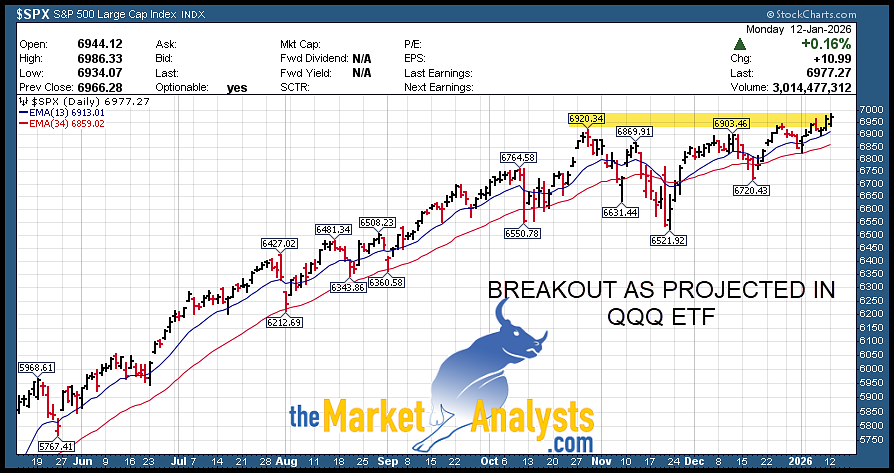

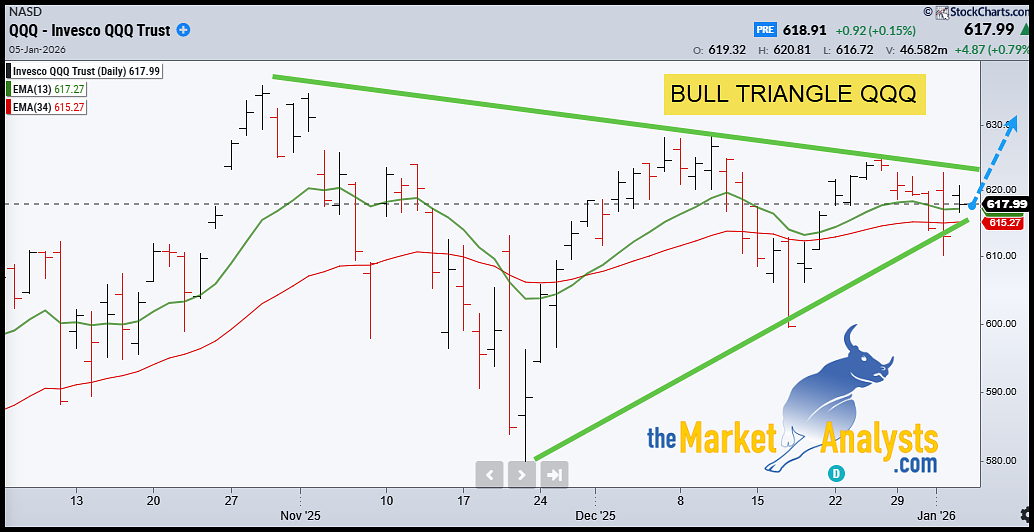

As noted yesterday here, maybe 6790 area will…