3x ETF A.M. Report 5.9

Website Tips: Your account link is listed below to manage your account

Account Link: [hidden link]

Track Record: REVIEW HERE

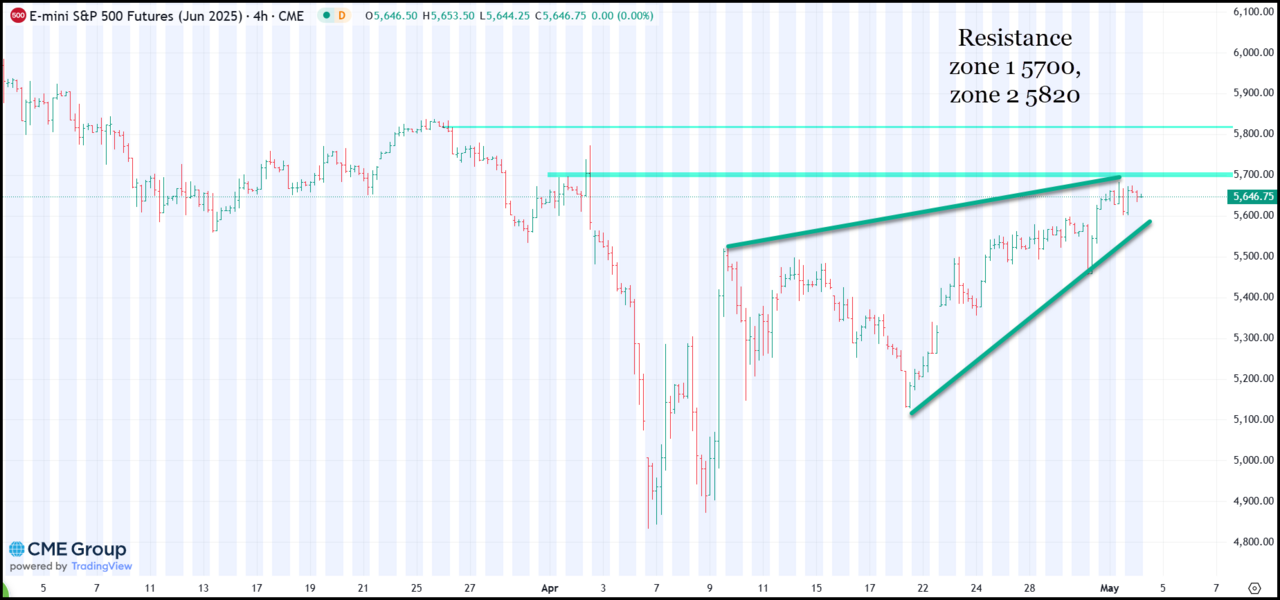

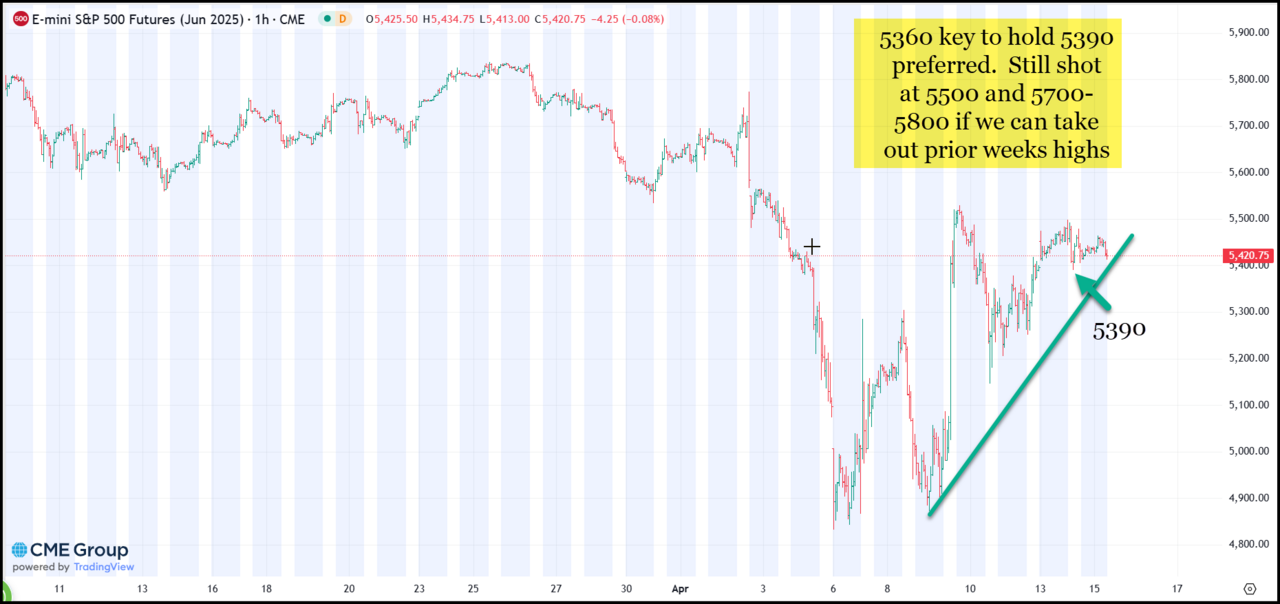

5740 the high so far on this…

Account Link: [hidden link]

Track Record: REVIEW HERE

5740 the high so far on this…