3x ETF Morning Updates Report 11.21

Website Tips: Your account link is listed below to manage your account

Account Link: [hidden link]

Track Record: REVIEW HERE

SP 500 Notes: ES Futures link to use

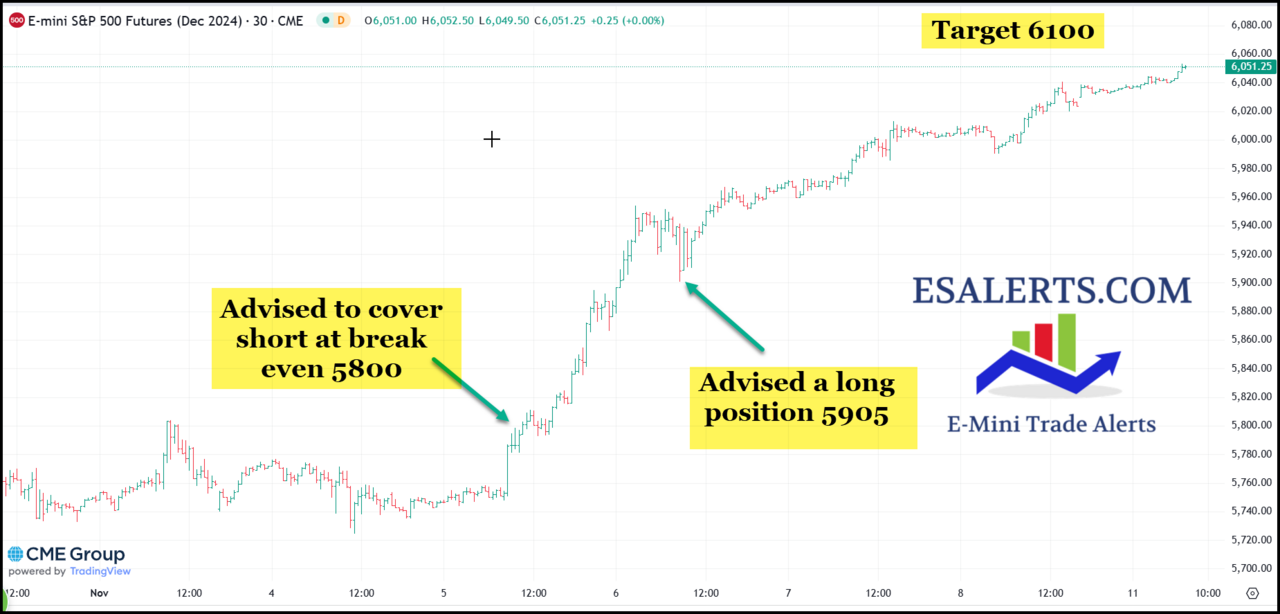

5965 area, I think we move up to re-test the November highs... esalerts has entered another long trade, we just closed a few more profitable trades, make sure to join. Its as easy as trading stocks, better risk controls…

Account Link: [hidden link]

Track Record: REVIEW HERE

SP 500 Notes: ES Futures link to use

5965 area, I think we move up to re-test the November highs... esalerts has entered another long trade, we just closed a few more profitable trades, make sure to join. Its as easy as trading stocks, better risk controls…